On the basis of which an adjustment invoice is issued. Adjustment invoice for reduction

Adjustment invoice from the supplier for an increase - what is this document and in what situations is it drawn up? What additional entries in tax registers and accounting should the supplier make when issuing it? What mistakes should be avoided so that the buyer does not have problems with deductions? We will answer these questions in our material.

Cases of issuing an adjustment invoice for an increase from the seller

An adjustment invoice for an increase from a supplier is a document with the help of which the data of the original invoice is adjusted in connection with a change in the cost of previously sold goods (works, services) as a result of an increase in their price or quantity.

For the supplier and the buyer this is always a retro event. With its help, VAT obligations of taxpayers to the budget for previously completed transactions and already issued invoices are clarified.

Possible situations where a supplier needs to issue an adjustment invoice for an increase are presented in the figure below:

If these events occur, the fact of an increase in the cost of goods sold occurs according to a certain pattern. It is necessary not only to issue an adjustment invoice for the increase, but also to make additions to tax registers and reporting, as well as to correct accounting.

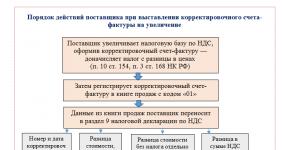

The cost of goods has increased: action plan

An increase in the cost of goods (work, services) requires taxpayers to take certain actions. All of them are dictated by tax and accounting legislation. We showed what these actions are in the diagram:

Let's look at an example of how a supplier should act when the cost of a product increases.

According to the agreement between PJSC Procurator (seller) and Technopolis LLC (buyer), a batch of goods of 326 pieces was shipped on September 10, 2018. with a total cost of RUB 2,673,200. (including VAT = RUB 407,776.27).

In October 2018, the parties to the transaction agreed to increase the unit price of the goods. As a result, the cost of delivery increased to RUB 2,722,100. (including VAT = RUB 415,235.59).

PJSC "Zagotovitel" issued an adjustment invoice to the buyer and registered it in the sales book for the 4th quarter of 2018. Additional entries were made in accounting:

|

Correspondence of invoices in the seller's accounting |

Amount, rub. |

Explanation |

|

|

Debit |

Credit |

||

|

In September 2018 |

|||

|

S/sch 90 "Revenue" |

2 673 200,00 |

Reflected revenue from the sale of goods to the buyer Technopolis LLC |

|

|

Account 68 “Calculations for VAT” |

407 776,27 |

VAT charged |

|

|

In October 2018 |

|||

|

S/sch 90 "Revenue" |

48 900,00 |

Adjustment of revenue due to an increase in price (RUB 2,722,100 - 2,673,200.00) |

|

|

Account 68 “Calculations for VAT” |

7 459,32 |

VAT adjustment (415,235.59 - 407,776.27 rub.) |

|

To make the process of issuing an adjustment invoice easier, see .

What to consider for the seller when issuing an adjustment invoice

The seller’s task when issuing an adjustment invoice is to arrange it in such a way that the buyer does not have any obstacles to obtaining a VAT deduction.

What you can do wrong:

If an error in an adjustment invoice does not prevent the tax authorities from reliably determining the name and cost of goods, the tax rate and amount of tax, as well as identifying the seller and buyer, its presence in the document will not prevent the buyer from deducting VAT.

Results

The supplier issues an adjustment invoice when the cost of the original shipment changes. Its increase may occur due to a change in price and (or) quantity of goods agreed upon by the parties to the contract, as well as in other cases (for example, by court decision). Issuing an adjustment invoice requires the seller to be careful (to avoid errors that would prevent deduction) and to make additional entries in tax and accounting records.

An adjustment invoice is not always issued when the cost of goods shipped (work performed, services rendered) changes. The procedure for preparing documents if corrections are necessary is clarified in the commented letter. (LETTER OF THE MINISTRY OF FINANCE OF THE RF dated 08.23.12 No. 03-07-09/125)

CHANGES REQUIRE BUYER'S CONSENT

Currently, the Tax Code provides for two ways to change the amounts of value added tax presented by the seller to the buyer - issuing an adjustment invoice and making corrections to a previously issued invoice without issuing an adjustment invoice. What is the difference between an adjustment and a correction?

An adjustment invoice is issued by the seller to the buyer if the cost of goods shipped, work performed, services provided, or transferred property rights has been changed (clause 3 of Article 168 of the Tax Code of the Russian Federation). Including:

When the price or tariff changes;

When specifying the quantity (volume) of goods shipped.

The commented letter emphasizes that a prerequisite for drawing up an adjustment invoice is the presence of any document (contract, agreement, other primary document) confirming the buyer’s consent (notification) to the change in value. That is, before issuing an adjustment document, the seller must notify the buyer about the change in the cost of shipped goods, or even better, enter into an appropriate agreement or contract (clause 13 of article 171, clause 10 of article 172 of the Tax Code of the Russian Federation). Without the execution of such a document, the validity of drawing up an adjustment invoice will be called into question.

Having agreed with the buyer on a change in price (or notified him of the change), the seller must issue an adjustment invoice to the buyer within five calendar days from the date of drawing up the relevant documents.

Increase in cost

At the same time, the seller must remember that if the cost of shipped goods (work performed, services rendered) changes upward, he is obliged to take into account the difference in the period when the goods were shipped (work performed, services rendered). This requirement is contained in paragraph 10 of Article 154 of the Tax Code of the Russian Federation.

This means that if an upward adjustment to the value is made in a subsequent tax period, the seller needs to submit an updated VAT return and pay additional tax.

The buyer accepts the difference for deduction based on the received adjustment invoice.

Cost reduction

In the event of a decrease in value, the seller does not correct the previously calculated tax base, but on the basis of the adjustment invoice drawn up by him, accepts tax deduction in the amount of the resulting difference (clause 1 of Article 169, clause 13 of Article 171 of the Tax Code of the Russian Federation).

The buyer should not forget about this feature: according to subparagraph 4 of paragraph 3 of Article 170 of the Tax Code of the Russian Federation, he must restore the difference in the amount of VAT accepted for deduction to the earliest date:

Or on the date of receipt of documents (agreements, contracts, etc.) for a change in the direction of reducing the cost of goods purchased, work performed, services rendered, property rights received;

Or on the date of receipt of the adjustment invoice*.

* This approach is confirmed in the letter of the Federal Tax Service of Russia dated 09.18.12 No. ED-4-3/15464, which contains the letter of the Ministry of Finance of Russia dated 09.03.12 No. 03-07-15/120 for information and use in work.

WHEN ERRORS ARE DETECTED, CORRECTIONS ARE MADE

If a technical error is identified in the initial invoice that does not allow one to reliably identify the supplier or buyer, the name of the goods (work, services) sold, their quantity, tax rate, or a counting error in the digital values of the price, cost of goods (work, services) and VAT amounts, then there is no need to prepare an adjustment invoice. In this case, corrections are made to the original invoice in the manner established by paragraph 7 of the Rules for filling out an invoice... (Section II of Appendix 1 to Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137). That is, a corrected invoice is drawn up. It contains the number and date of the original document (line 1), the number and date of correction (line 1a) and other indicators - new (which were not previously indicated) or clarified.

FORM MATTER

The commented letter from the Ministry of Finance of Russia also draws attention to the fact that the form of the adjustment invoice used by the organization before the adoption of Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 (that is, before the appearance of the officially approved form) must comply with the requirements for the adjustment invoice, provided for in paragraphs 5.2 and 6 of Article 169 of the Tax Code of the Russian Federation.

Officials pointed out that failure to comply with the established requirements when the cost of shipped goods (work performed, services rendered) changes downward is grounds for refusal to allow the seller to deduct the amount of value added tax. In other words, if the adjustment invoice does not contain all the details (data) provided for by the Tax Code, then the seller does not have the right to deduct VAT on such an invoice.

Please note that VAT payers have been able to prepare adjustment invoices since October 1, 2011**.

** The concept of “adjustment invoice” was introduced by Federal Law dated July 19, 2011 No. 245-FZ.

Before approving the form of the adjustment invoice, the Federal Tax Service of Russia, in a letter dated September 28, 2011 No. ED-4-3/15927, provided the recommended form it developed (it does not coincide with the officially approved form).

Since the letter from the tax department is not a mandatory regulatory act, taxpayers had the right to use the form of an adjustment invoice developed by them independently, containing all the details provided for by the Tax Code. This adjustment invoice was recognized as the proper basis for VAT tax deductions before the officially approved form began to be applied.

Thus, we believe that it is advisable for selling organizations to check previously issued adjustment invoices for compliance with the specified requirements and, if necessary, reissue them (replacing the copies issued to buyers).

Since October 1, 2011, the concept of “adjustment invoice” has appeared in tax legislation. However, it is not always used when changes occur related to the data specified in the source documents. Let's look at what situations require issuing an adjustment invoice and when it is not needed.

Purpose of a correction invoice

An adjustment invoice is issued by the seller when there is a change in the cost of goods shipped by him (work performed, services rendered, transferred property rights), if such clarification is associated with an increase or decrease in the price or quantity (volume) of products already sold (clause 1 of Article 169 of the Tax Code of the Russian Federation ). The document indicates the old and new value of goods (work, services, property rights) and the amount of change in this value. If the cost of 2 or more delivery lots has changed, then in this case you can issue either an adjustment invoice separately for each original document, or a single adjustment invoice. If such a change is repeated, a new adjustment invoice is issued, into which data from the previous adjustment document is transferred to compare the cost (letters of the Ministry of Finance of Russia dated 09/05/2012 No. 03-07-09/127, dated 12/01/2011 No. 03-07-09/ 45, Federal Tax Service of Russia dated December 10, 2012 No. ED-4-3/20872@).

However, it should be remembered that before issuing an adjustment invoice, the seller must notify the buyer of a change in the cost of goods shipped (work performed, services rendered, property rights transferred) and obtain his consent to such a change.

Read about the rules for filling out an adjustment invoice in the article “Sample of filling out an adjustment invoice (2017-2018)” .

When is an adjustment invoice needed?

The seller of goods (works, services) must issue an adjustment invoice in the following cases:

- after shipment of goods (transfer of works, services) when clarifying the price, if the shipment of products was carried out at a preliminary price, and it was agreed with the buyer that the final price would be determined later (letter of the Ministry of Finance of Russia dated January 31, 2013 No. 03-07-09/1894, dated January 28, 2013 No. 03-03-06/1/39);

- when returning to the seller goods that were not accepted for registration by the buyer, for example, low-quality goods or when a defect is discovered (letters of the Ministry of Finance of Russia dated 08/10/2012 No. 03-07-11/280, dated 08/07/2012 No. 03-07-09/109, dated 02.03.2012 No. 03-07-09/17, dated 02.27.2012 No. 03-07-09/11, dated 20.02.2012 No. 03-07-09/08, Federal Tax Service of Russia dated 05.07.2012 No. AS-4-3 /11044@);

- upon disposal of low-quality goods by the buyer, agreed with the seller, even if the goods have been capitalized (letter of the Ministry of Finance of Russia dated July 13, 2012 No. 03-07-09/66);

- when returning goods from a buyer who is not a value added tax payer, if the goods have already been accepted by him for registration (letters of the Ministry of Finance of Russia dated July 31, 2012 No. 03-07-09/96, dated July 24, 2012 No. 03-07-09/ 89, dated 07/03/2012 No. 03-07-09/64, dated 05/16/2012 No. 03-07-09/56);

- if the buyer discovers a discrepancy between the quantity of goods received and the quantity indicated by the seller in invoices and invoices, for example, a shortage (letter of the Ministry of Finance of Russia dated May 12, 2012 No. 03-07-09/48, dated March 12, 2012 No. 03-07-09/22 , Federal Tax Service of Russia dated 01.02.2013 No. ED-4-3/1406@, dated 12.03.2012 No. ED-4-3/4100@);

- if there is a discrepancy in the volume of services (work) accepted by the customer compared to the quantity specified by the contractor in acts and invoices when the cost of these services (work) changes as a result of clarification of the quantity (letter of the Federal Tax Service of Russia dated 01.02.2013 No. ED-4-3/ 1406@).

When an adjustment invoice is not needed

An adjustment invoice is not required when the seller provides bonuses or incentives to the buyer. Such bonuses do not affect the cost of products sold (work performed, services rendered, property rights), i.e., the tax base does not change and no adjustment is required (clause 2.1 of Article 154 of the Tax Code of the Russian Federation).

In addition, there are situations when it is necessary to make corrections to the original invoice rather than issue an adjustment:

- If the change in cost is associated with the correction of an arithmetic or technical error that arose due to incorrect entry of the price or quantity of goods shipped (work performed, services provided) (letter of the Ministry of Finance of Russia dated 08/23/2012 No. 03-07-09/125, dated 08/15/2012 No. 03-07-09/119, dated 08.08.2012 No. 03-07-15/102, dated 07.31.2012 No. 03-07-09/95, dated 04.16.2012 No. 03-07-09/36, dated 05.12 .2011 No. 03-07-09/46, Federal Tax Service of Russia dated August 23, 2012 No. AS-4-3/13968@). For example, it is necessary to correct an invoice if the error occurred due to incorrect data entry into programs designed for accounting and tax accounting (letter of the Ministry of Finance of Russia dated November 30, 2011 No. 03-07-09/44, Federal Tax Service of Russia dated February 1, 2013 No. ED-4-3/1406@). However, in practice it is very difficult to determine whether there is a technical (arithmetic) error or whether there are grounds for issuing a correction invoice.

- When the final price of a consignment of goods is determined after shipment based on quotes. In this case, corrections are also made to the “shipping” invoice, drawn up indicating the planned prices, since the calculation of the price of goods does not change (letter of the Ministry of Finance of Russia dated December 1, 2011 No. 03-07-09/45).

Sometimes, when the price (tariff) or quantity (volume) of goods (work, services), property rights changes, neither an adjustment nor a corrected invoice needs to be drawn up. So, if the seller knows that the price and quantity of shipped products will be updated within 5 days from the date of sale, then he just needs to wait for these changes and issue an invoice taking into account the new prices or the updated quantity. After all, according to paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, when selling goods (work, services), transferring property rights, invoices are issued no later than 5 calendar days, counting from the day of shipment of goods (performance of work, provision of services), from the date of transfer of property rights.

Results

After a shipment has already been made, it may be necessary to adjust the data on the quantity or price of goods sold in connection with reaching an agreement to change 1 of these indicators. In this case, an adjustment document is drawn up reflecting the original shipment data, their new value and the amount of change. Such a document is not used to correct errors made during registration.

Adjustment invoice: registration procedure

In tax legislation, the concept " adjustment invoice"appeared thanks to the Law of July 19, 2011 N 245-FZ. The relevant norms came into force on October 1, 2011. However, by this time the form of the adjustment invoice had not been approved by the Government, as required by paragraph 8 of Article 169 NK. The Federal Tax Service eliminated the vacuum. In Letter dated September 28, 2011 No. ED-4-3/15927@, the Federal Tax Service of Russia provided the recommended form of an adjustment invoice and the procedure for filling it out.

Adjustment invoice for sales of goods (services) in 2018

In Letter No. ED-3-3/3608@ dated November 2, 2011, the tax authorities explained that this form can be filled out in any convenient way. There are no other restrictions, in particular on paper format.

Initially, it was stipulated that the form developed by the Federal Tax Service was not at all mandatory. However, in any case, taxpayers can use it only until the relevant Government Resolution comes into force. It, in turn, has already appeared. We are talking about Resolution No. 1137 of December 26, 2011, which approved, among other things, the form of the adjustment invoice. It is precisely this that must be applied from the moment the said Resolution comes into force.

What where When?

Before proceeding with a comparative analysis of the recommended and already permanent form of an adjustment invoice, it is worth remembering the following points.

Firstly, in accordance with paragraph 3 of Art. 168 of the Tax Code, the adjustment invoice applies when the cost changes shipped goods (work performed, services rendered), transferred property rights. This kind of adjustment occurs, in particular, when changing prices (tariffs) and/or clarification of the quantity (volume) of goods shipped.

Second, before issuing an adjustment invoice, the seller must notify the buyer of changes(prices, volume of supply). Moreover, it is important to obtain the buyer’s consent to such adjustments. And only if there is a contract, agreement, or other primary document confirming the consent (fact of notification) of the buyer to change the cost of goods shipped or their quantity (volume), the seller or buyer will subsequently be able to claim a VAT deduction based on an adjustment invoice.

Thirdly, the seller is obliged to issue an adjustment invoice no later than five calendar days from the date of drawing up a document confirming the consent (fact of notification) of the buyer about the change in the cost of shipped goods.

New form: distinctive features

So, we remembered when and within what time frame an adjustment invoice should be issued. Now is the time to compare its recommended form and the permanent form that has replaced it, approved by Decree of the Government of the Russian Federation N 1137.

First of all, let us note the individual “cap” changes that are taking place. So, now, in addition to the number and date of the adjustment invoice (line 1), you need to indicate the serial number and the date of the correction (line 1a), if any. And if previously in the form recommended by the Federal Tax Service it was required to indicate only the details of the initial invoice (line 1.1), then from now on, in addition to this, you must additionally indicate the number and date of its correction, again if it was entered, and line 1b is intended for this information.

In addition, line 4 has appeared in the header of the adjustment invoice. It indicates the name of the currency and its digital code. This data is simply transferred from line 7 of the original invoice.

As for the “middle”, as promised, officials have made it more convenient to fill out; in any case, the plate now easily fits on one page. And achieving this, as it turned out, is not so difficult. Simply, instead of piling up columns that reflected the data “Before the change”, “After the change”, as well as the difference between “For additional payment” and “To reduce”, the corresponding data is entered into the following rows of the table specially designated for them:

- A (before the change) - the indicators of the original invoice are included in it;

— B (after change) — it shows data after changing the cost of goods.

The indicators for lines B (increase) and D (decrease) are calculated as follows: from the data in line A, the corresponding indicator in line B is subtracted. If the result is negative, then we are dealing with an increase in the cost of goods, which means it must be entered in line B without a minus sign . Otherwise, i.e. If the result is positive, line D is filled in.

Here we note another interesting point. In clause 5.2 of Art. 169 of the Tax Code provides a list of mandatory details that must be reflected in the adjustment invoice. In paragraphs 13 of this norm, in particular, it is established that if the cost of shipped goods changes downward, the corresponding difference between the tax amounts calculated before and after the change is indicated with a negative sign. Meanwhile, following the procedure for filling out an adjustment invoice, there cannot be any negative values in it. A similar “incident” occurred in the recommended form of an adjustment invoice. Representatives of the Federal Tax Service of Russia in Letter No. ED-3-3/3608@ dated November 2, 2011 explained that a negative sign means that the difference indicator is reflected when the cost of goods shipped (work performed, services rendered, transferred property rights) is reflected in the column “To reduce ". Moreover, they emphasized that in this case, entering data with a positive sign will allow the seller to increase the amount of tax claimed for deduction (and not reduce the amount of tax deductions). In other words, the seller receives the right to apply a VAT deduction in connection with a decrease in the cost of goods shipped (work performed, services provided, transferred property rights) in accordance with clause 13 of Art. 171 NK. Apparently, officials decided to maintain this principle.

The rules for filling out most of the details of an adjustment invoice are similar to those established for the initial, that is, regular invoice. In particular, the cost indicators of the adjustment invoice (in lines A, B, C and D, columns 4 - 6, 8, 9) are indicated in rubles and kopecks (US dollars and cents, euros and euro cents, or in another currency). And in certain cases, the entry “without excise tax” or “without VAT” is entered in column 6 and column 8, respectively.

Filling out the adjustment invoice is completed by summing up the following indicators: cost without VAT (column 5), amount of VAT (column 8) and cost with VAT (column 9). And this data will be useful when registering an adjustment invoice in the Journal of Received and Issued Invoices, as well as in the Purchase Book, Sales Book or additional sheets to these books.

Note! All invoices, including adjustments and corrections, drawn up on paper or electronically, are subject to a single registration in chronological order: in part 1 of the Invoice Log by the date of their preparation, and in part 2 - by the date of receipt.

Registering a correction invoice

The procedure for registering adjustment invoices primarily depends on whether the cost of delivery has decreased as a result of the adjustments or, on the contrary, increased.

In the General case, the Journal of received and issued invoices indicates the number and date of the adjustment invoice, as well as the details of the original invoice. At the same time, the Journal takes into account only the results of the adjustments made (decrease or increase in the supply price and corresponding adjustments to VAT amounts), and therefore such indicators as “Cost of goods, (work, services), property rights on the invoice - total” and “Including "The amount of VAT on the invoice" does not need to be filled in (columns 14 and 15).

Cost reduction. Let us note that in this case the seller has the right to deduct the overpaid amount of VAT, and the buyer will have to restore the “excess” tax accepted for deduction. Moreover, in accordance with paragraphs. 4 p. 3 art. 170 of the Tax Code, tax restoration is carried out in the tax period in which the earliest of the following dates falls:

— the date of receipt by the buyer of primary documents for a change in the direction of reducing the cost of purchased goods (work performed, services rendered), acquired property rights;

- the date the buyer receives an adjustment invoice issued by the seller when there is a downward change in the cost of goods shipped (work performed, services rendered) and transferred property rights.

This explains the procedure for recording the corresponding adjustment invoices.

Thus, the seller issues an adjustment invoice and registers it in Part 1 of the Journal of Received and Issued Invoices (hereinafter referred to as the Journal). It is specifically stated that the seller does not reflect this document in Part 2.

The adjustment invoice must then be recorded in the Purchase Ledger. After all, it is based on its data that the amount of VAT claimed for deduction (reimbursement) is determined. And the seller has the right to deduction, in accordance with clause 10 of Art. 172 of the Tax Code, arises when the following conditions are met: it is necessary to have an adjustment invoice and a “primary document” confirming the notification (consent) of the buyer to adjust the transaction price.

In the tax period in which they were performed, the seller registers the adjustment document.

In turn, the buyer registers an adjustment invoice in Part 2 of the Journal, since the amount of VAT payable to the budget increases. Next, he must register in the Sales Book either an adjustment invoice or a “primary invoice” confirming the change in delivery conditions, depending on what he received earlier.

Table 1. Transfer of data from the adjustment invoice to the purchase and sales books when the cost of delivery is reduced

Increase in cost. If the cost of delivery increases, the seller becomes obligated to pay additional VAT to the budget, so he registers the issued adjustment invoice in Part 1 of the Journal. Also, the document must be registered either in the Sales Book or in an additional sheet to the Sales Book. Determining exactly where the data on the adjustment invoice needs to be reflected is not difficult. If the shipment and adjustment occurred in the same tax period, we register it in the Sales Book. In the case when these events occur in different quarters, the adjustment invoice must be reflected in the additional list to the Sales Book, generated for the tax period when the shipment took place.

As for the seller, as a result of such adjustments, he has the right to deduct the difference between the tax amounts calculated before and after the change. The Buyer registers an adjustment invoice when the cost of goods increases in Part 2 of the Journal. And in the Purchase Book it must be “assigned” to the tax period in which the buyer had both an adjustment invoice and a primary document confirming the change in the supply price.

Table 2. Transfer of data from the adjustment invoice to the purchase and sales books when the cost of delivery increases

February 2012

Invoice, VAT deduction, VAT recovery

Features of registration of adjustment

invoices in the book of purchases and sales

1.

Adjustment invoice for reduction from the seller

Registration of an adjustment invoice by the seller when reducing the cost of shipped goods

If the cost of goods decreases, the seller registers an adjustment invoice in the purchase book in the tax period in which the right to deduct VAT arose (paragraph 1, paragraph 13, article 171, paragraph 10, article 172 of the Tax Code of the Russian Federation). A deduction is possible on the basis of an adjustment invoice if there is a contract, agreement or other primary document confirming the consent (fact of notification) of the buyer to change the cost of shipped goods.

In Letter dated September 28, 2011 N ED-4-3/15927@, the Federal Tax Service of Russia draws attention to the following features of registering an adjustment invoice in the purchase book:

- the indicators from column 9b (difference to be reduced) of the line “Total on adjustment invoice” of the adjustment invoice are transferred to column 7 of the purchase book;

- data from column 5b (difference to be reduced) of the line “Total on adjustment invoice” of the adjustment invoice is transferred to column 8a (9a) of the purchase book;

- indicators from column 8b (difference to be reduced) of the line “Total on adjustment invoice” of the adjustment invoice are transferred to column 8b (9b) of the purchase book.

2. Registration of an adjustment invoice by the seller when the cost of shipped goods increases

The increase in the cost of shipped goods is taken into account when determining the tax base for the period in which they were shipped (clause 10 of Article 154 of the Tax Code of the Russian Federation).

Therefore, if the value of goods has increased after the expiration of the tax period in which they were shipped, the seller must record an adjustment invoice on an additional sheet in the sales ledger. The Federal Tax Service of Russia draws attention to the following:

- in column 1 of the additional sheet of the sales book, the date and number of the adjustment invoice are indicated;

- data from column 9c (difference to additional payment) of the line “Total on adjustment invoice” of the adjustment invoice is transferred to column 4 of the additional sheet of the sales book;

- indicators from column 5c (difference to additional payment) of the line “Total on adjustment invoice” of the adjustment invoice are transferred to column 5a (6a) of the additional sheet of the sales book;

- data from column 8c (difference to additional payment) of the line “Total on adjustment invoice” of the adjustment invoice is transferred to column 5b (6b) of the additional sheet of the sales book.

If the increase in the cost of goods occurred in the same tax period as the shipment of goods, the adjustment invoice should be recorded in the sales ledger for the same period.

In other words, if the initial transaction price increases, the seller must pay an additional amount of tax to the budget. Moreover, such additional accrual is made not in the adjustment period, but in the quarter when the sale was reflected (clause 13 of Article 171 of the Tax Code of the Russian Federation). Accordingly, the adjustment invoice in this case is registered in the sales book of the tax period in which the shipment was made (fulfillment, provision, transfer). Moreover, if the adjustment is made in another tax period (not in the quarter of shipment), the obligation arises to compile an additional sheet of the sales book.

Moreover, in the event of an increase in the initial transaction price, the seller is obliged to submit an updated VAT return to the tax authority.

3. Registration of an adjustment invoice by the buyer when the cost of purchased goods decreases

The buyer is obliged to restore the VAT corresponding to the difference between the amount of tax calculated from the cost of shipped goods and the amount of tax calculated after reducing this value (subclause 4, clause 3, article 170 of the Tax Code of the Russian Federation). The restoration must be made in the tax period in which either the adjustment invoice or the primary document on the reduction in the value of shipped goods was received (depending on which of these documents was received first).

To recover the tax, the buyer must register an adjustment invoice or source document in the sales ledger. At the same time, according to the Federal Tax Service of Russia, it is necessary to pay attention to the following:

- Column 1 of the sales book indicates the date and number of the adjustment invoice or primary document for reducing the cost of goods;

- indicators from column 9b (difference to be reduced) of the line “Total on adjustment invoice” of the adjustment invoice are transferred to column 4 of the sales book;

- data from column 5b (difference to be reduced) of the line “Total on adjustment invoice” of the adjustment invoice is transferred to column 5a (6a) of the sales book;

- indicators from column 8b (difference to be reduced) of the line “Total on adjustment invoice” of the adjustment invoice are transferred to column 5b (6b) of the sales book.

4. Registration of an adjustment invoice by the buyer when the cost of purchased goods increases

The buyer registers an adjustment invoice in the purchase book in the tax period in which the right to deduct VAT arose (paragraph 2, paragraph 13, article 171, paragraph 10, article 172 of the Tax Code of the Russian Federation). In this case, the features of the procedure for registering an adjustment invoice in the purchase book are as follows:

- Column 2 of the purchase book indicates the date and number of the adjustment invoice;

- data from column 9c (difference to additional payment) of the line “Total on adjustment invoice” of the adjustment invoice is transferred to column 7 of the purchase book;

- indicators from column 5c (difference to additional payment) of the line “Total on adjustment invoice” of the adjustment invoice are transferred to column 8a (9a) of the purchase book;

- data from column 8c (difference to additional payment) of the line “Total on adjustment invoice” of the adjustment invoice is transferred to column 8b (9b) of the purchase book.

In the event of an increase in the initial transaction price, the buyer has the right to deduct the additional amount of VAT presented. The right to deduct the difference in VAT arises after receiving an adjustment invoice in the presence of an agreement (agreement, other primary document confirming the consent (fact of notification) of the buyer) to change the value, but no later than three years from the date of drawing up the adjustment invoice (clause 10, Article 172 of the Tax Code of the Russian Federation).

One of the main questions that taxpayers have in connection with the use of adjustment invoices is the possibility of issuing and the correct execution of a repeated adjustment invoice. But this issue is not described in the Tax Code, therefore the Federal Tax Service of Russia issued the corresponding explanations in its Letter No. ED-4-3/20872@ dated December 10, 2012.

Firstly, the Federal Tax Service of Russia reminds that in paragraph 5.2 of Art. 169 of the Tax Code of the Russian Federation contains a list of details that the taxpayer must indicate in the adjustment invoice. These include, in particular, the serial number of the primary invoice and the date of its preparation, as well as the total difference between the indicators of the primary invoice and the data calculated after the change in the cost of goods, works or services, as well as transferred property rights.

Appendix No. 2 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations for value added tax” provides rules for filling out an adjustment invoice.

According to paragraphs 1 and 2 of this Appendix, line 1b of the adjustment invoice must indicate the number and date of the invoice for which the adjustment is drawn up. If in the adjustment invoice the columns on line A are filled in (i.e., data before the change), then the corresponding indicators of the columns of the invoice for which the adjustment is drawn up are indicated.

Because an adjustment invoice is drawn up, in accordance with the law, for the difference between the initial data and indicators after a change in the cost of goods or work, services, then in the event of a repeated change in cost, the seller issues it. In this case, all data from the first adjustment invoice is transferred to the second one: i.e. line A of the repeated adjustment invoice reflects the data of line B of the previous adjustment invoice.

Based on this, according to the Federal Tax Service of Russia, in the repeated adjustment invoice in line 1b it is necessary to indicate the number and date of the previous adjustment invoice.

In case if repeated adjustment invoice in line 1b contains information from the primary invoice (before adjustments), then, according to paragraph.

How to reflect an adjustment invoice for a reduction?

2 p. 2 art. 169 of the Tax Code of the Russian Federation, for tax authorities this cannot be a basis for refusing to accept the amount of VAT for deduction, because this error does not prevent them from identifying the seller, buyer or the cost of goods, work or services, as well as the rate and amount of VAT, etc. .

These are not all the questions that taxpayers have when using adjustment invoices. Therefore, in order to avoid errors when using them, you can try to redo the main invoice and accompanying documents.

In tax legislation, the concept " adjustment invoice"appeared thanks to the Law of July 19, 2011 N 245-FZ. The relevant norms came into force on October 1, 2011. However, by this time the form of the adjustment invoice had not been approved by the Government, as required by paragraph 8 of Article 169 NK. The Federal Tax Service eliminated the vacuum. In Letter dated September 28, 2011 No. ED-4-3/15927@, the Federal Tax Service of Russia provided the recommended form of an adjustment invoice and the procedure for filling it out in Letter dated November 2, 2011 No. ED. -3-3/3608@ tax officials explained that this form can be filled out in any convenient way, there are no other restrictions, in particular on paper format.

Initially, it was stipulated that the form developed by the Federal Tax Service was not at all mandatory. However, in any case, taxpayers can use it only until the relevant Government Resolution comes into force. It, in turn, has already appeared. We are talking about Resolution No. 1137 of December 26, 2011, which approved, among other things, the form. It is precisely this that must be applied from the moment the said Resolution comes into force.

What where When?

Before proceeding with a comparative analysis of the recommended and already permanent form of an adjustment invoice, it is worth remembering the following points.

Firstly, in accordance with paragraph 3 of Art. 168 of the Tax Code, the adjustment invoice applies when the cost changes shipped goods (work performed, services rendered), transferred property rights. This kind of adjustment occurs, in particular, when changing prices (tariffs) and/or clarification of the quantity (volume) of goods shipped.

Second, before issuing an adjustment invoice, the seller must notify the buyer of changes(prices, volume of supply). Moreover, it is important to obtain the buyer’s consent to such adjustments. And only if there is a contract, agreement, or other primary document confirming the consent (fact of notification) of the buyer to change the cost of goods shipped or their quantity (volume), the seller or buyer will subsequently be able to claim a VAT deduction based on an adjustment invoice.

Thirdly, the seller is obliged to issue an adjustment invoice no later than five calendar days from the date of drawing up a document confirming the consent (fact of notification) of the buyer about the change in the cost of shipped goods.

New form: distinctive features

So, we remembered when and within what time frame an adjustment invoice should be issued. Now is the time to compare its recommended form and the permanent form that has replaced it, approved by Decree of the Government of the Russian Federation N 1137.

First of all, let us note the individual “cap” changes that are taking place. So, now, in addition to the number and date of the adjustment invoice (line 1), you need to indicate the serial number and the date of the correction (line 1a), if any. And if previously in the form recommended by the Federal Tax Service it was required to indicate only the details of the initial invoice (line 1.1), then from now on, in addition to this, you must additionally indicate the number and date of its correction, again if it was entered, and line 1b is intended for this information.

In addition, line 4 has appeared in the header of the adjustment invoice. It indicates the name of the currency and its digital code. This data is simply transferred from line 7 of the original invoice.

As for the “middle”, as promised, officials have made it more convenient to fill out; in any case, the plate now easily fits on one page. And achieving this, as it turned out, is not so difficult. Simply, instead of piling up columns that reflected the data “Before the change”, “After the change”, as well as the difference between “For additional payment” and “To reduce”, the corresponding data is entered into the following rows of the table specially designated for them:

- A (before the change) - the indicators of the original invoice are included in it;

- B (after change) - it shows data after changing the cost of goods.

The indicators for lines B (increase) and D (decrease) are calculated as follows: from the data in line A, the corresponding indicator in line B is subtracted. If the result is negative, then we are dealing with an increase in the cost of goods, which means it must be entered in line B without a minus sign . Otherwise, i.e. If the result is positive, line D is filled in.

Here we note another interesting point. In clause 5.2 of Art. 169 of the Tax Code provides a list of mandatory details that must be reflected in the adjustment invoice. In paragraphs 13 of this norm, in particular, it is established that if the cost of shipped goods changes downward, the corresponding difference between the tax amounts calculated before and after the change is indicated with a negative sign. Meanwhile, following the procedure for filling out an adjustment invoice, there cannot be any negative values in it. A similar “incident” occurred in the recommended form of an adjustment invoice. Representatives of the Federal Tax Service of Russia in Letter No. ED-3-3/3608@ dated November 2, 2011 explained that a negative sign means that the difference indicator is reflected when the cost of goods shipped (work performed, services rendered, transferred property rights) is reflected in the column “To reduce ". Moreover, they emphasized that in this case, entering data with a positive sign will allow the seller to increase the amount of tax claimed for deduction (and not reduce the amount of tax deductions). In other words, the seller receives the right to apply a VAT deduction in connection with a decrease in the cost of goods shipped (work performed, services provided, transferred property rights) in accordance with clause 13 of Art. 171 NK. Apparently, officials decided to maintain this principle.

The rules for filling out most of the details of an adjustment invoice are similar to those established for the initial, that is, regular invoice. In particular, the cost indicators of the adjustment invoice (in lines A, B, C and D, columns 4 - 6, 8, 9) are indicated in rubles and kopecks (US dollars and cents, euros and euro cents, or in another currency). And in certain cases, the entry “without excise tax” or “without VAT” is entered in column 6 and column 8, respectively.

Filling out the adjustment invoice is completed by summing up the following indicators: cost without VAT (column 5), amount of VAT (column 8) and cost with VAT (column 9). And this data will be useful when registering an adjustment invoice in the Journal of Received and Issued Invoices, as well as in the Purchase Book, Sales Book or additional sheets to these books.

Note! All invoices, including adjustments and corrections, drawn up on paper or electronically, are subject to a single registration in chronological order: in part 1 of the Invoice Log by the date of their preparation, and in part 2 - by the date of receipt.

Registering a correction invoice

The procedure for registering adjustment invoices primarily depends on whether the cost of delivery has decreased as a result of the adjustments or, on the contrary, increased.

In general, the number and date of the adjustment invoice, as well as the details of the original invoice, are indicated. At the same time, the Journal takes into account only the results of the adjustments made (decrease or increase in the supply price and corresponding adjustments in VAT amounts), and therefore such indicators as “Cost of goods, (work, services), property rights on the invoice - total” and “Including "The amount of VAT on the invoice" does not need to be filled in (columns 14 and 15).

Cost reduction. Let us note that in this case the seller has the right to deduct the overpaid amount of VAT, and the buyer will have to restore the “excess” tax accepted for deduction. Moreover, in accordance with paragraphs. 4 p. 3 art. 170 of the Tax Code, tax restoration is carried out in the tax period in which the earliest of the following dates falls:

- the date of receipt by the buyer of primary documents for a change in the direction of reducing the cost of purchased goods (work performed, services rendered), acquired property rights;

- the date the buyer receives an adjustment invoice issued by the seller when there is a downward change in the cost of goods shipped (work performed, services rendered) and transferred property rights.

This explains the procedure for recording the corresponding adjustment invoices.

Thus, the seller issues an adjustment invoice and registers it in Part 1 of the Journal of Received and Issued Invoices (hereinafter referred to as the Journal). It is specifically stated that the seller does not reflect this document in Part 2.

The adjustment invoice must then be recorded in the Purchase Ledger. After all, it is based on its data that the amount of VAT claimed for deduction (reimbursement) is determined. And the seller has the right to deduction, in accordance with clause 10 of Art. 172 of the Tax Code, arises when the following conditions are met: it is necessary to have an adjustment invoice and a “primary document” confirming the notification (consent) of the buyer to adjust the transaction price.

In the tax period in which they were performed, the seller registers the adjustment document.

In turn, the buyer registers an adjustment invoice in Part 2 of the Journal, since the amount of VAT payable to the budget increases. Next, he must register in the Sales Book either an adjustment invoice or a “primary invoice” confirming the change in delivery conditions, depending on what he received earlier.

Table 1. Transfer of data from the adjustment invoice to the purchase and sales books when the cost of delivery is reduced

Increase in cost. If the cost of delivery increases, the seller becomes obligated to pay additional VAT to the budget, so he registers the issued adjustment invoice in Part 1 of the Journal. Also, the document must be registered either in the Sales Book or in an additional sheet to the Sales Book. Determining exactly where the data on the adjustment invoice needs to be reflected is not difficult. If the shipment and adjustment occurred in the same tax period, we register it in the Sales Book. In the case when these events occur in different quarters, the adjustment invoice must be reflected in the additional list to the Sales Book, generated for the tax period when the shipment took place.

As for the seller, as a result of such adjustments, he has the right to deduct the difference between the tax amounts calculated before and after the change. The Buyer registers an adjustment invoice when the cost of goods increases in Part 2 of the Journal. And in the Purchase Book it must be “assigned” to the tax period in which the buyer had both an adjustment invoice and a primary document confirming the change in the supply price.

Table 2. Transfer of data from the adjustment invoice to the purchase and sales books when the cost of delivery increases

February 2012